Friday, 20 November 2020

Special Consideration for Washington Teacher Who Is a Military Spouse

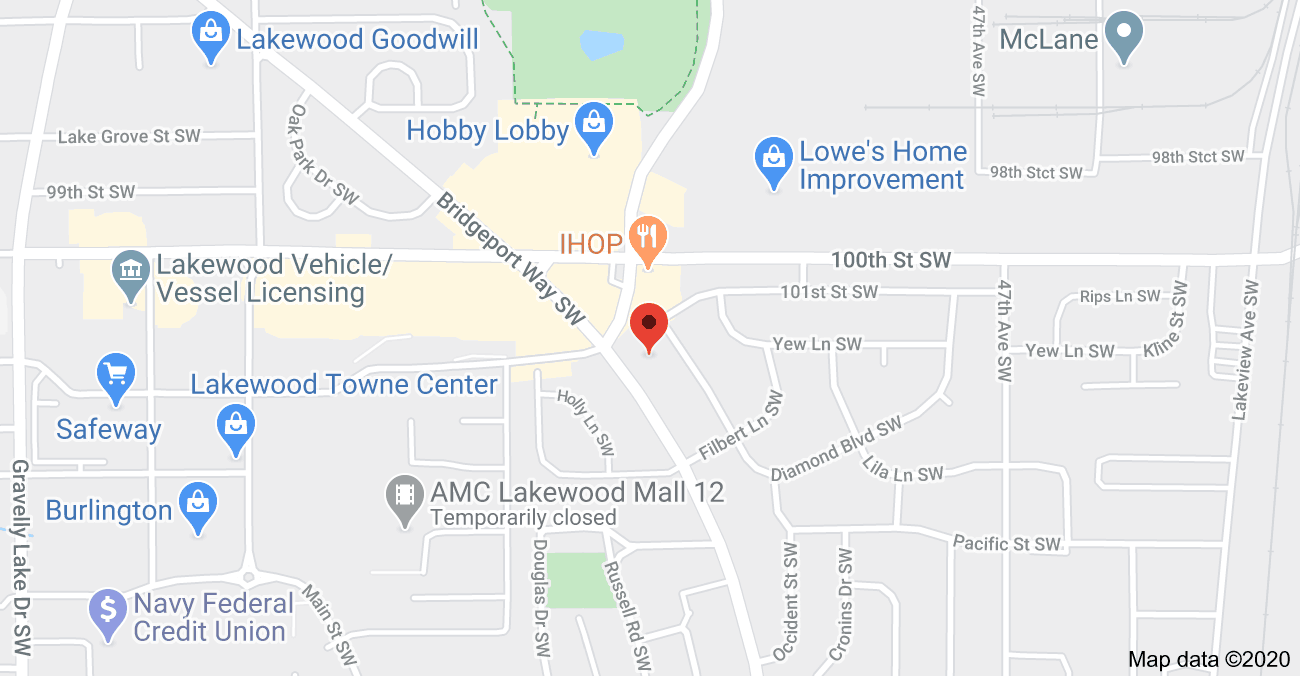

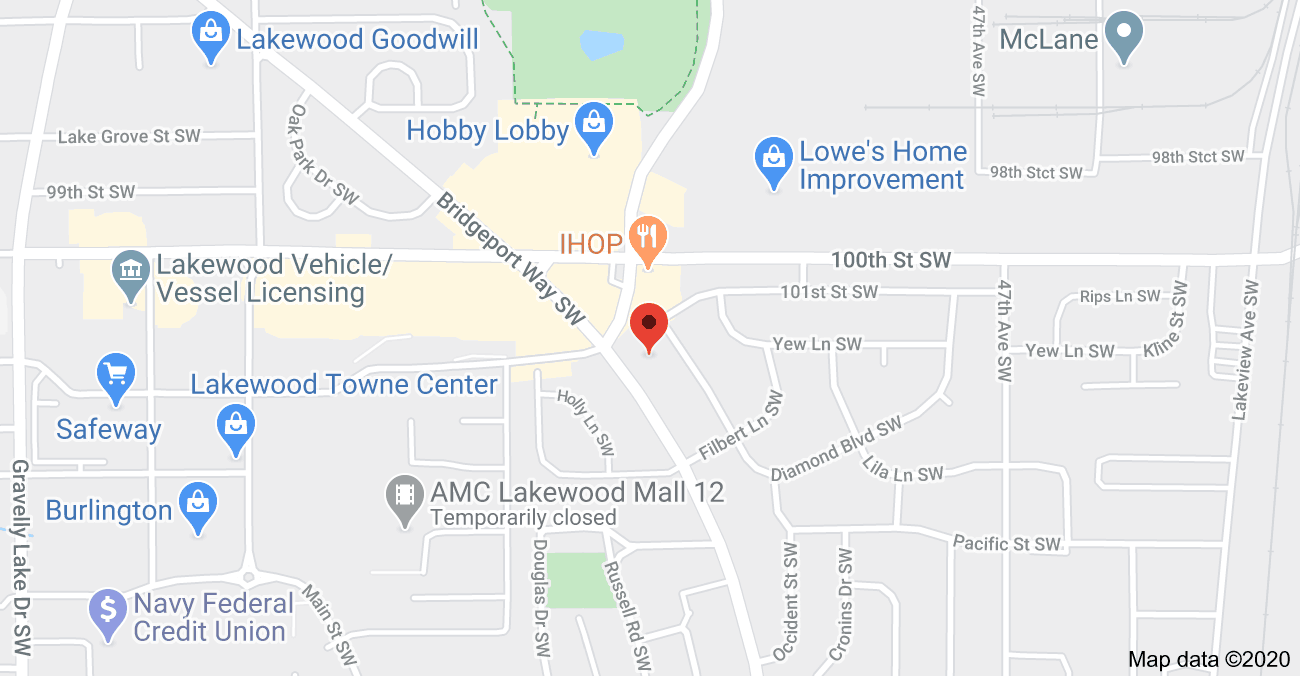

As a financial planner who is located close to Joint Base Lewis McChord (JBLM), I often come across a unique set of teachers. A new teacher whose spouse is in the military. Many of them have teaching experience in other states.

One of the most common questions we get is: how does the Washington TRS (Teachers’ Retirement System) or SERS (School Employees’ Retirement System) work? Many are confused with the industry terminology like defined benefit versus defined contribution, nor do they have the time to dedicate to learning it. It’s our passion to educate teachers and school employees about their retirement investments and financial wellbeing. Don’t feel embarrassed if you do not even know which retirement plan you are in, many of your peers are with you. Many experienced teachers and those in leadership positions who do not have complete understanding of their retirement accounts or the TRS system.

We also understand that many teachers are burdened with large student loans. If you are a teacher who carries a large amount of school debt, we may be able to help you. There are multiple loan forgiveness programs that you can take advantage of (depending on your eligibility): Teachers Loan Cancellation, Teachers Loans Forgiveness, and Public Service Loan Forgiveness (PSLF). Non-teacher school employees may also be eligible to have student loans forgiven under PSLF. While each program can be confusing, we can help you explore these programs and work toward a better financial footing.

If you are in TRS Plan 3, you may know that your ability to change your contribution rate was closed on January 31st, 2015 (Source). However, you can still contribute more into your retirement by contributing into a 403b Plan. In a matter of fact, this option is eligible for many eligible teachers and school employees.